charitable gift annuity example

Charitable Gift Annuities An Example. Because they need continuing income.

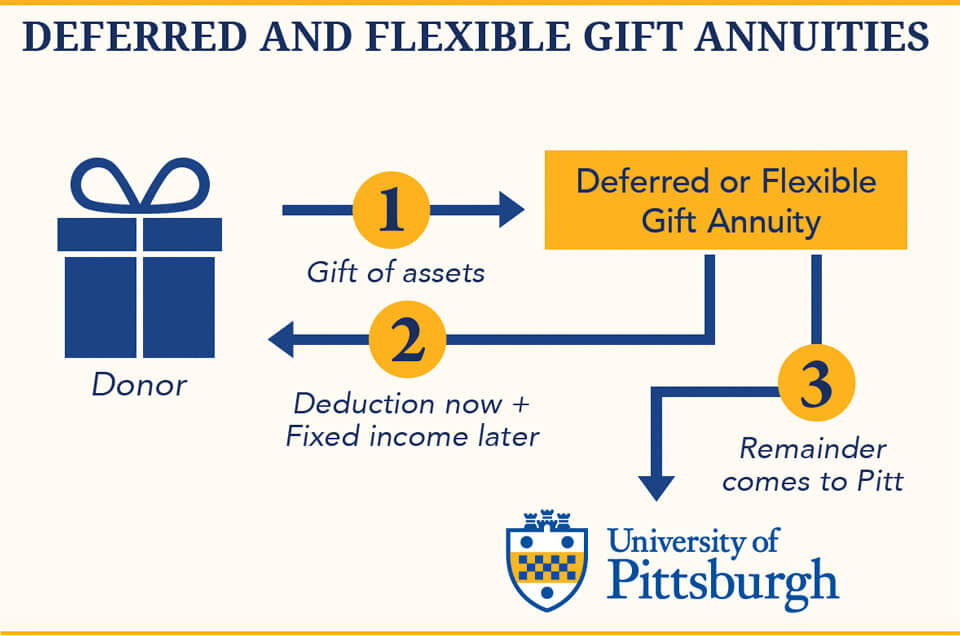

Charitable Gift Annuities The University Of Pittsburgh

Annuities are often complex retirement investment products.

. Example assumes a 34 percent applicable federal rate AFR and a federal income tax bracket of 35. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. When your gift annuity.

Ad Check Out this Free eBook for Tips on How to Cultivate and Secure Donations. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Ad Giving Through Your Donor Advised Fund is a Powerful Way to Help Struggling Seniors.

Ad Pursue Your Philanthropic Vision With Bank of America Private Bank. Ad Earn Lifetime Income Tax Savings. In exchange Georgetown pays you a fixed amount each year for the rest of your life.

Charitable Gift Annuities An Example Our donor age 75 plans to donate a maturing 25000 certificate of deposit to the International Rescue Committee. It Really Does Feel Good to Give to Those in Need. Because they need continuing income they decide.

Charitable Gift Annuities An Example Our donor age 75 plans to donate a maturing 25000 certificate of deposit to AARP Foundation. Because they need continuing. Charitable Gift Annuities An Example.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Learn some startling facts. State tax liability is not.

Charitable Gift Annuities An Example. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Charitable Gift Annuities An Example.

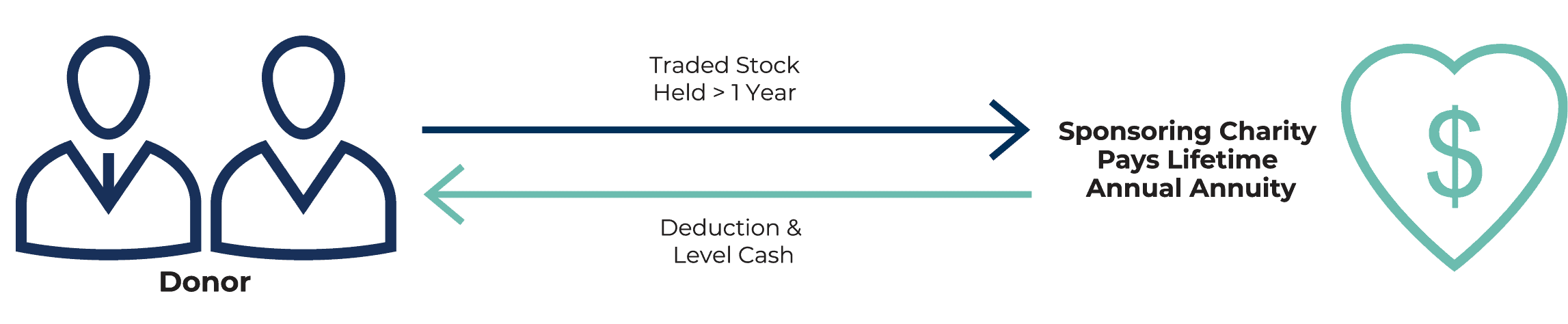

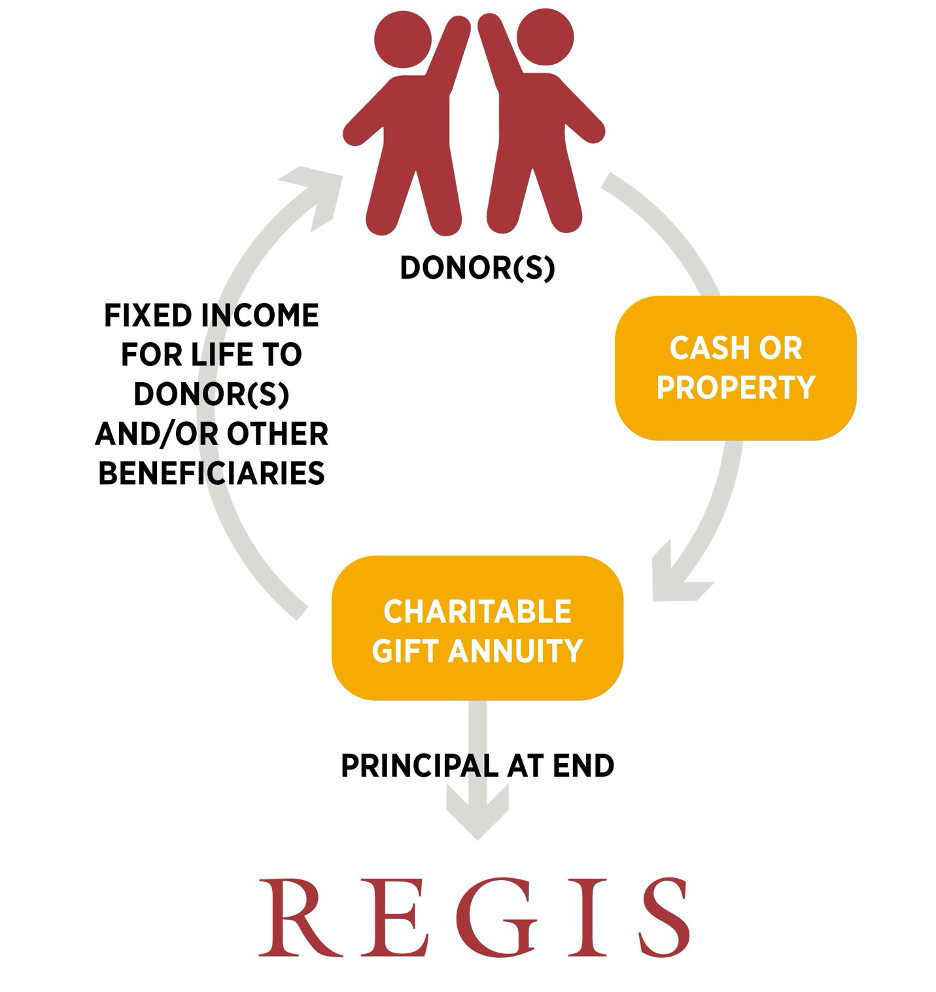

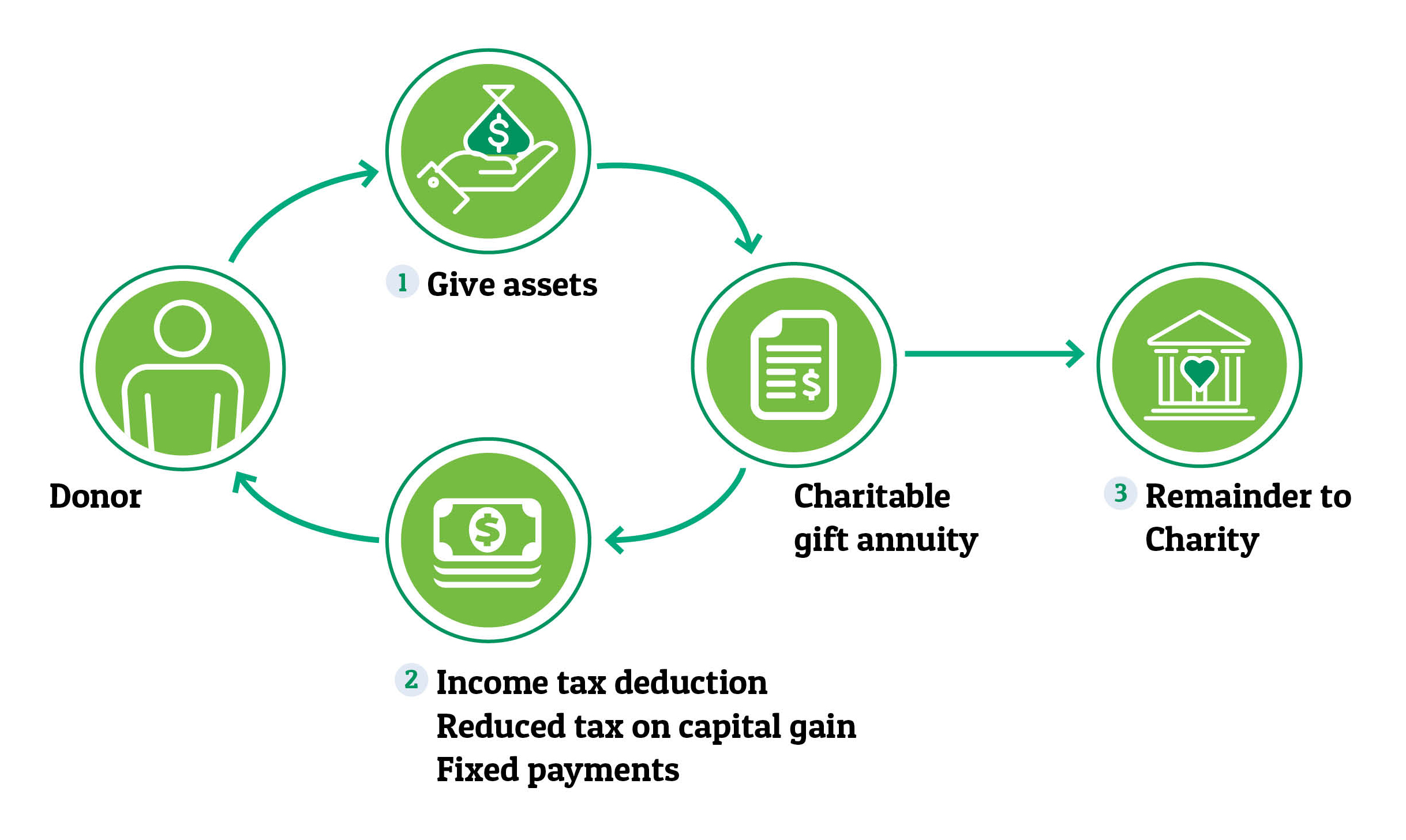

ESTABLISHING YOUR GIFT ANNUITY A charitable gift annuity from InFaith Community Foundation offers the opportunity to make a charitable gift today and in turn receive a life. Fox example future income payments are subject to the ability of the charity to pay claims inclusive of all. Based on their ages they will receive a payout rate of 59 percent 2950 each year for life and are.

Donate Today to Help Struggling Seniors. They donate 50000 in cash to Hadassah to establish a two-life charitable gift annuity. Give Gain With CMC.

Charitable Gift Annuities An Example Our donor age 75 plans to donate a maturing 25000 certificate of deposit to Humane Society International. A graphic illustration of a charitable gift annuity is available. A charitable gift annuity example.

You make an irrevocable gift of cash securities or other property to Georgetown. For example one regulation governing a charitable gift annuity assumes that the money left over after all payment obligations have been satisfied the residuum should be. Its Never Been More Important for Your Donor Management Software to Help Retain Donors.

After Anns death the balance of the invested funds will go to her favorite qualifying charities including a local animal shelter. Charitable gift annuities as with all things have benefits and risks. One benefit of a charitable bequest is that it.

Charitable Gift Annuities An Example. A charitable bequest is a bequest written in a will or trust that directs a gift to be made to a qualified exempt charity when you pass away. Ad Get this must-read guide if you are considering investing in annuities.

In exchange Wellesley pays you a fixed amount each year for the rest of your life. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Ad Pursue Your Philanthropic Vision With Bank of America Private Bank.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. You make an irrevocable gift of cash securities or other property to Wellesley.

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity Tax Deductions Cga Rates Ren

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

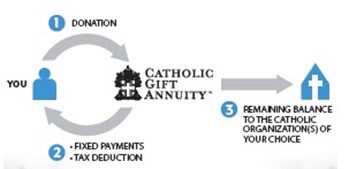

Charitable Gift Annuity Matching Program Catholic Extension

Charitable Gift Annuity Saint Paul Minnesota Foundation

Gift Annuity Montreat College In North Carolina

Charitable Gift Annuity American Red Cross Help Those Affected By Disasters

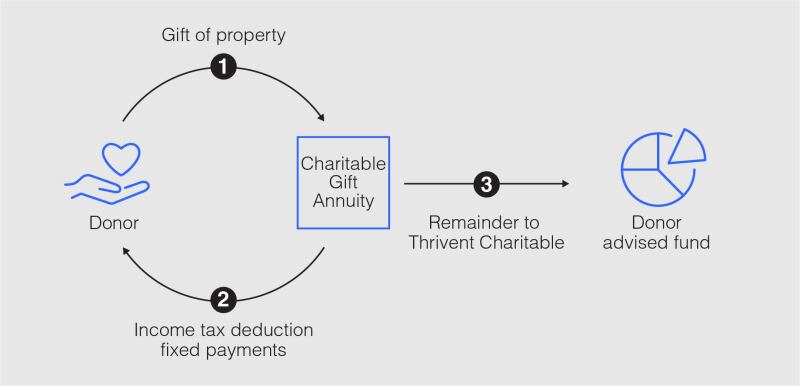

What Is A Charitable Gift Annuity Thrivent

Charitable Gift Annuities Development Alumni Relations

Gifts That Pay You Income The Salvation Army Western Territory Arc

Charitable Gift Annuities Barnabas Foundation

Charitable Gift Annuity Deferred University Of Virginia School Of Law

Charitable Gift Annuities Giving To Stanford

Life Income Gfts Regis College

Charitable Gift Annuities National Wildlife Federation

Charitable Gift Annuity Claremont Mckenna College

Charitable Gift Annuity Focus On The Family

Consumer Report Gift Annuity Calculator

Www Ogtogosurvey Com Ogtogosurvey Complete Olive Garden Guest Satisfaction Survey Olive Garden To Go Olive Gardens Olive Gardens Menu